Introduction

Until the present crisis and the cessation of most social and economic activity the main concern in people’s minds was the economic challenges and opportunities created by Brexit. By contrast with the challenges ahead presented by the economic fallout of the national lockdown, those posed by Brexit now seem insignificant. Predictions vary as to how bad this is going to be, but the consensus seems to be worse than the financial crash of 2008, as bad or worse than the Great Depression of the 1930, and even as bad as the Great Frost of 1709 which devastated the economy throughout Europe. What I want to focus on, though, is the opportunity for a fundamental rethink that this crisis presents. I should hasten to add that this is not intended as a panacea to the economic woes that we undoubtedly face in the short to medium term, but a hypothesis about the true nature of economic value, which, if not foretelling the end of capitalism dreamed of by socialists, at least attempts to place capitalism on a different footing.

Before moving on to this hypothesis, two misconceptions about economic value need to be dealt with. The first misconception is that economic value is money value. Actually, when you stop to think about money its power is quite mysterious. We all know that the material value of money is not equivalent to its purchasing power. Whence, then, comes this excess value? Felix Martin in his 2013 book, Money, has examined the history of various forms of currency and demonstrated that money in whatever form is a marker of credit and debit established in a relationship of trust. Incidentally, he puts paid to the idea that the economy has evolved through three stages – barter, money and credit – and shows that from the earliest time before any currencies came into existence the idea of credit was prevalent.

The second misconception is that the base of economic value is well established and permanent. Although trust is fundamental, trust in what? Trust requires a guarantee of some sort, but what constitutes a guarantee has varied between cultures and historic eras. In the ancient world a man’s word was sacrosanct and a violation of that trust would lead to dishonour or death; in the great empires and kingdoms, the emperor or king’s authority was the guarantee, and their image was embossed on all coinage; at one time it was the value of silver, more recently of gold or other rare metals. Today, a system called fiat currency operates in most countries, being based not on the supposed value of some commodity such as gold, silver or oil, but on the legitimacy and stability of the political and economic system in that country. This has an advantage from the perspective of governments in that it allows them to borrow more than they hold in tangible assets such as gold, on the basis of goodwill. However, it means the economic system is susceptible to loss of trust depending on events. The financial markets chart what is essentially the levels of optimism and pessimism in the system.

A shifting economic paradigm

What this tells us it that the basis of economic value shifts over time and most probably to reflect the political realities, for example in Britain the change from a feudal monarchical system to a parliamentary system. Does the looming economic crisis represent such a tectonic shift in history? By itself, probably not, but combined with the new wave of nationalism, the slow crumbling of the post-WWII settlement and the threat to employment from AI and widespread automation, then possibly.

There are two basic attitudes to the economic future of the nation with respect to the crisis triggered by the Covid 19 pandemic. Both recognise the enormous damage caused by the economic lockdown, but their interpretations of this are entirely different. The prevalent view is that things will gradually get back to normal and that it will take months, years or even decades to regain the economic vitality that prevailed prior to the crisis, depending on how optimistic or pessimistic one is. The other view, dominant on the left, though not exclusive to it, is that the lockdown has precipitated a long predicted ‘crisis of capitalism’ which will inaugurate the move to a different economic model. While I make no firm predictions, I want to explore some of the fundamentals of economic value in light of changes of shifting social attitudes in the last few decades, in order to understand what might change and what would be good to change.

The interesting question at the start of this is why, given the universally recognised damage that this economic shutdown has done to our future prospects, not only financial, but future health and well-being, did the government decide on such a draconian policy. There were other strategies available, such as the route of herd immunity while encouraging social-distancing pursued by Sweden or the systematic contact tracing and testing of citizens in Singapore and Taiwan, both of which have kept the economy largely open.

Probably the decisive factor in the government’s strategy was the clamour from the people, egged on by the press, for a strategy that at all costs, put the preservation of life above all other considerations. I have very mixed feelings about this. On the one hand I feel it reflects a growing timidity among people, a fear of death and suffering that they believe someone – usually the government – has a responsibility to protect them from. It also, of course, plays into the hands of those on the left, who will take up any cause that strengthens central control and economically distributive policies that could be implemented in the wake of the collapse of capitalism and the free market, despite the fact that this has proven disastrous wherever and whenever it has been implemented. Still, the preservation of life and of the quality of life constituted by the precious relationships within the family, community and friendship circles is certainly something worth protecting. My point is that whatever our personal feelings about this, we may be witnessing a sea change in the culture and in the balance of power between government and people. If that is so, it is worth seeing what the positive outcomes of this might be, although this paper will focus on the economic outcomes.

My hypothesis is that we are moving towards a time in which the basis of economic value will be trust in the quality of the people within the nation. Before moving on to analysing and I hope justifying this belief as a rational belief, I want to emphasise how different a basis for the economy that would be. We all accept how successful in a limited sphere the capitalist free market system has been, in that it has drawn every country out of extreme poverty, where it has been implemented in other favourable conditions of political stability and the rule of law. But, for all the benefits that the present economic system has brought us, there are a number of deep-seated problems.

First, it is an extraordinary fact that the world economy for the past decade or more is resting on massive debt. At the beginning of 2020, i.e. before the economic crisis and government responses to it have even been factored in, global debt was estimated at $257 trillion; in the UK £1.6 trillion, about 75% of GDP. Some have likened it to walking along a cliff edge: manageable as long as you don’t look down. The financial crisis of 2008 was caused by somebody looking down. The injection of money into the economies of countries such as the UK, USA, France and Germany to tide over the businesses and citizen during this unprecedented economic closure take the levels of debt to new heights. The only foreseeable means repay this debt in the present economic paradigm is a generation of penury.

Secondly, at least until the present crisis wiped away almost all other considerations, one of the great preoccupations among economic theorists, was the expectation that AI (artificial intelligence) and the automation of many professions as well as manual jobs, would create a workless workforce and precipitate social turmoil. A common response to this scenario has been the advocacy of some form of Universal Basic Income (UBI), and some are seeing in the present fiscal stimulus its precursor. I have argued elsewhere against the idea of UBI as one that removes the sense of worth we gain from earning a place in society, supporting a family and the causes we choose, saving for something special and supporting society in general through our taxes.

Third, there is a moral objection to much of the present economic paradigm as constituted at the moment, which is that people are viewed essentially as economic units, to be trained and fitted into the prevailing economic objectives and priorities. Such a view permeates education, which is essentially to take up a place in the existing economic order. Of course, I understand that institutions and businesses have to be built upon factors such as hiring the best people for the job and this does not necessarily negate broader considerations of people’s life beyond work. Still, particularly in a globalised economy, as we have seen, this excludes many people from satisfying work as the promoting of the global best, which is to the advantage of companies, often disadvantages the potential local employee who is sufficiently competent.

The human value hypothesis and institutional wealth theory

The hypothesis that the future of the economy will be based on trust in the quality of the people can be considered from the viewpoint of basic qualities of resilience, education, conscientiousness, cooperation and creativity. It is questionable whether the people are displaying much resilience at the moment, but this could be accounted for by a transition in the relationship between government and people. People by and large are compliant to government orders at the moment; but these orders are exactly what they wanted, in order to be protected. I am hopeful that, rather than a wholesale expansion of the state’s authority, this augurs a move to a more responsive and benevolent state, which more closely represents the will of the people. In time and in response to the challenges that lie ahead the natural resilience of the people will reassert itself. It is remarkable that in the midst of this crisis almost a million people volunteered to work in the NHS and countless more undertook to look after old and vulnerable neighbours. Cooperation and creativity speak largely for themselves as economic factors. There is a natural pool of creativity among people, which flourishes best when people face challenges, but are not excessively hampered by regulation. Government will need to do all it can to unleash this creativity in the coming years.

At one level, the hypothesis is common sense. After all, economies are the sole preserve of human beings. There are precursors in nature, such as cooperation and symbiosis between species that provide advantages to all involved. There is also growing evidence that there is an element of culture among higher species that enable the transmission of knowledge, but this is obviously of a very different qualitative order to that of human culture. We can say that economies are unique to humans, so that to say the basis of economic value on which an economy rests is due to human activity is hardly a stretch of the imagination. However, human history is complex and, certainly from a perspective of the religious sphere, is a fallen human history, so that the true human value has never been realised or recognised. Certainly, history has been one of struggle and the dominance of the powerful who have not just appropriated to themselves the wealth created by the majority, but also obscured the origin of wealth.

As a hypothesis, the belief that we are moving to an economic system based on human quality is open, if not exactly to testing, at least to falsification. It is a conjecture based partly on observation of trends, particularly in the present crisis, but also long term shifts in culture and also based on moral reasoning; even if I’m not enamoured of the reason we have ended up here, where we might be heading is something like where we should be heading in a just world. The important issue to be considered then is the theoretical underpinning of the hypothesis: when – at which place and through what activity – does human value, i.e. the quality of the people, become transformed into measurable economic value. My belief is that it takes place in successful institutions. The key concept here is ‘wealth’; successful institutions generate wealth which, like the term ‘prosperity’, means more than money – it represents well-being, opportunity, freedom, optimism, growth and development as well as purchasing power. Indeed, the monetary aspect of wealth as I define it here, is relative to the institution. We tend to think of wealth in material and absolute terms, so that wealth means having amounts of money and assets and poverty means having few or none. But wealth as an ethical and relative term is an indicator of the performance of institutions. Rather than engage in a diatribe against monetary wealth as the cause of poverty, the persistent drumbeat of believers in equality of outcome, we should be looking to the causes of success or failure in human qualities and in institutions. It is necessary, therefore, to define what is meant here by ‘institution’ and by ‘success’.

By ‘institution’ I mean any human grouping that has some sense of a common purpose, some shared values, a degree of organisational structure however informal, perhaps some rules, and a boundary demarking inside from outside. This would include businesses and all manner of organisations and even individual family units. It would not, for example, include neighbourhoods as geographic entities, but would include neighbourhood associations. Wealth is generated by and accumulates around such institutions and their activities. All institutions need money to function and this has to be considered integral to the institutional ontology not as an add-on. However, while some institutions, such as banks, are required to process huge quantities of money, others, such as voluntary or community-based organisations, might run on a shoestring but be fully functional in achieving their nominal purpose.

All successful institutions generate wealth and wealth as defined here includes social capital and individual worth as well as money and assets. The question arises then as to what constitutes the economy. There is, in fact, a broad answer and a narrow answer. The broad answer is that the economy is the engine for the generation of wealth in the sense defined here. There is to my knowledge one country, Bhutan, that is looking at Gross National Happiness as an important factor in national development (Ura et al, 2012). The narrower and by far more common definition focuses on those activities that contribute to GDP, such as profitable businesses. But, in considering success, there is overlap between these two concepts.

Wealth goes hand in hand with success in any venture, and that success is built by gradually building relations of trust around that venture. Building a successful venture requires a range of skills and the ability to work hard, for example, but connecting these skills to the demands and opportunities of the market requires institutional success and the creation of multidimensional trust, both within an organisation and outside in relation to other relevant organisations and constituencies. Edward Freeman (Freeman et al, 2010), in his work on Stakeholder theory, states that for a business to be successful it has to think multidimensionally to all the various interested parties, or ‘stakeholders’, of which it is constituted and to which it relates: its shareholders, certainly, but also its management, its employees, its customers, its suppliers, banks and so on, and ensure that each of these is happy. Happiness is a rather slippery concept when applied so liberally to different groups and interests, but I think it can be fairly accurately equated to establishing trust and focusing on the satisfaction of each stakeholder

Trust is not something that can be established at once, and not necessarily easily, and it is something that can be rapidly destroyed. However, as Fukuyama (1995) has argued, trust is the fundamental value of social capital, one which enabled the growing prosperity of Europe through the early modern period. If this is true, I suspect it is because, unlike other values which are (or run the risk of being) etiolated when they are monetised, it has the property of self-replenishment. The building of trust, therefore, should be a fundamental goal of every organisation. First, everyone feels happier when they are in an environment in which they feel trusted. When people feel happy they willingly contribute to the good of the whole and invest themselves, their efforts and time for the success of the whole. There is a common interest that whatever goods or services they provide should be to a high standard of quality, and when they are to a high quality the recipient of those goods or services will naturally be satisfied. Those who fund the activities of the organisation, whether consumers, shareholders, banks, or donors should be treated as extended constituencies of the organisation, common values discovered and a basis for trust and satisfaction established. This is the basis for success and wealth in any organisation. The same reasoning can also be applied to an individual and a basic social institution such as a family.

However, while stakeholder theory grasps success at a systemic level, it does not address at the micro level how wealth as defined here is generated. This is important, because if the economic future is to be based upon the quality of the people, what is it ultimately that turns this into the wealth of nations, of the sort that contributes to GDP and trade balances and the like? Surprisingly, it is Karl Marx who proposed one of the most innovative, if flawed, solutions to this problem, though its obvious shortcomings also suggest what the real answer is.

Marx (1859) advanced a view that, rather than arising from nature, the intrinsic value of a commodity represented the ‘congealed labour time’ of the industrial proletarian whose sweat and toil had manufactured it. Marx was motivated to blame capitalism for the dreadful conditions of the industrial working class which sprang up in the newly growing cities created by the industrial revolution. He identified the profit generated in the manufacturing process as an ‘excess’ derived from the exploitation of the workers who had created the value of the commodities, that is by paying them insufficiently for their labour. A clear objection to this idea is that the price – even the marketability – of any commodity is a function of its quality and the demand for it. If a manufactured item is shoddy or faulty it cannot demand the same price in the market as one which is made to high standards, regardless of the labour invested in it, while if there is no demand for an item, it will not sell. Price is determined largely by these two factors, quality and demand, and any business in order to be profitable, has to identify a market where a certain demand exists and strive for quality that meets the market’s expectations.

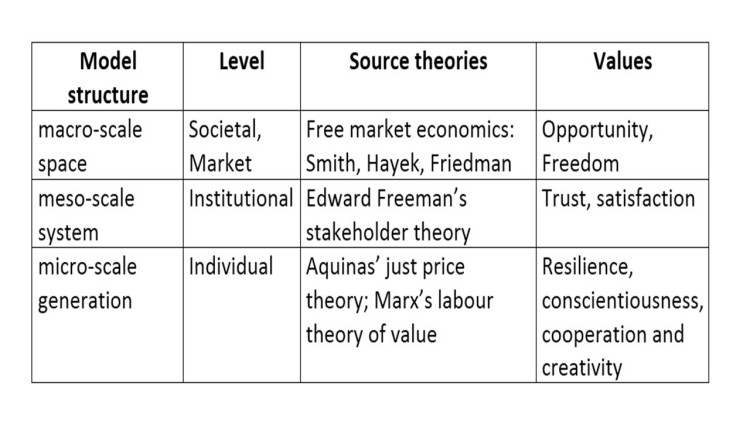

The shortcomings of Marx’s view are addressed by stakeholder theory. Marx extrapolated from the labour of an individual to economic value in the market, whereas stakeholder theory understands that the labour of an individual is subsumed within the institutional structure of the business, which has to meet the requirements of success in the marketplace. However, an interpretation of Marx would see that it is the very activity of the individual and the investment of their quality – which we earlier stated to be their resilience, knowledge, conscientiousness, cooperation and creativity – which gives rise to the goods and services in which the business trades and even less tangible goods such as inspired leadership and wise management. Thus, Marx’s labour theory of value is partially rehabilitated by being updated into the modern workplace and understood in the institutional context of market success, where it helps to fill in a philosophical gap in the institutional ontology of stakeholder theory. The model for institutional wealth theory is shown in fig.1 below.

Fig.1 Theoretical model for institutional wealth generation

The model synthesises economic activity at three scales: the market, the institution and the individual, but also of three ontological modalities: the space for economic activity, the systemic context for economic activity and the productive/generative activity, together with their typical values. It postulates that labour generative activity (suitably translated into the work of the modern business) utilises and transforms the value quality of the workforce in a systemic, cooperative and multidimensional fashion, a necessary mediating condition between the individual and the market. The decisive factors in linking this generative activity to the market are demand and product/service quality and both are addressed at the institutional level. Social capital is input and output at both the meso and micro scales. The model is adaptive to high finance and minimal finance institutions.

Potential objections to the hypothesis and theory

The decisive refutation of the hypothesis would be if everything simply went back structurally to where it was before, that is with the resumption of crony capitalism rather than a genuine free market – except of course for the unimaginable suffering caused by mass unemployment, a generation of blighted hopes, and the resentment at the prospect of the rich getting still richer. Were this to happen, the future could be very dark, with the establishment of a totalitarian government of the left or right. That would not invalidate it as an ethically enlightened principle, of course, but that is not the same thing. However, unless there is an irrefutable critique of the proposition that trust in the quality of the people is a rational basis for the economy, I cannot see it failing to gain traction as we reflect on the increasingly apparent vulnerabilities and injustices of the system we have created, besides its proven strengths and virtues.

A theoretical objection would be that wealth simply means the accumulation of money or its equivalent in assets. This is a commonly held view but it arises out of the mistaken understanding of the nature of money and economic value. Once the fundamental nature of the economy as trust, guarantee, credit and debt are understood, the role of social capital in wealth generation is clear. This narrow perspective on wealth also justifies the (im)moral view (not that I am saying that everyone who shares this understanding of wealth shares this view) that gaining money is a justifiable end in itself, and it does not matter the means by which one acquires it. Clearly, such a view underlies criminal acquisition, whether that be corporate crime, gang-related crime or street robbery. The view proposed here is that wealth should be understood as a reward for, or a consequence of, institutional strengthening. Theft short-circuits that process; it does not represent the justly deserved reward for valued activity, which reinforces the values of social institutions, but leaves the basis of social chaos in its wake: mistrust, fear and loss. Moreover, the empowering function of money cannot be fully realised; its power to purchase is always accompanied by fear of exposure, fear of punishment, mistrust of others and the knowledge that one is not truly worthy in that one has not been rewarded. Unfortunately, this is the common understanding of wealth; as a result, as a society we are left to take effective measures to counter the increasing prevalence of economic crime and its social fallout, whereas we should be establishing as a norm the correct understanding of wealth, that people can police themselves and support each other more effectively.

A second objection to the theory would be that many organisations seem to function, even function well, while not adhering to the strategy outlined by stakeholder theory. This is due to the dampening effect of society; changes rarely happen suddenly, but usually there is a cumulative effect before something becomes apparent. The economic crisis was building up and was predicted by some many years in advance, as indeed the recovery is many years in manifesting itself. When any institution fails, whether it be large or small, there are always underlying reasons, and those reasons invariably come down to human problems: the arrogance of a leader, the disaffection and even sabotage of those mistreated, greed and eventually dishonesty undermining trust. Even failure to adapt to a changing environment can be laid at the feet of systemic failure to build relations of trust, because that is a failure to draw upon the variety of skills, to discover and to exploit the skills that any group of people bring with them.

Conclusion

The UK and other nations face many challenges in the years ahead. For the UK, in particular, the effects of the crash of 2008, Brexit and now the lockdown in response to the pandemic, pose severe economic challenges. But they also present opportunities in a new economic paradigm that has the potential to revitalise the free market system albeit in a more curtailed global system. Key is recognising the individual economic actors working cooperatively as supplying the qualities upon which the national wealth is created. Rather than a distributive economy we need to be thinking more about how to generate a vibrant social capital and give access to a wide range of skills and opportunities for increased participation for all abilities. In such a paradigm we do not need to be fearful of the advent of AI; whatever its power, it should and would be harnessed to extend our capabilities, not to replace them.

References

Freeman, E. R., Harrison, J. S., Wicks, A. C., Parmar, B. L. and De Colle, S. (2010). Stakeholder Theory: The State of the Art. Cambridge, UK: Cambridge University Press.

Fukuyama, F. (1995). Trust: The social virtues and the creation of prosperity. London: Penguin.

Martin, F. (2013). Money: The Unauthorised Biography. London: The Bodley Head.

Marx, K (1859). A Contribution to the Critique of Political Economy. Moscow: Progress Publishers.

Ura, K., Alkire, S., Zangmo, T. and Wangdi, K. (2012). An Extensive Analysis of GNH Index. Thimphu, Bhutan: The Centre for Bhutan Studies. Online: http://www.grossnationalhappiness.com/wp-content/uploads/2012/10/An%20Extensive%20Analysis%20of%20GNH%20Index.pdf